per capita tax revenue

Inflation-Adjusted to 2020 Dollars 6694. Jacob Goss and Chang Liu.

Economic Growth And Tax Revenue Sofia

From a panel study of states across the US we find that the individual income tax rate is significantly negatively correlated with per capita.

. GNI per capita formerly GNP per capita is the gross national income converted to US. Total tax revenue as a percentage of GDP indicates the share of a countrys output that is collected by the government through taxes. Tax burden of the population Total tax receipts of the US.

FTA Revenue Estimating Conferences. Revenues Per Capita. For most areas adult is defined as 18 years of age and older.

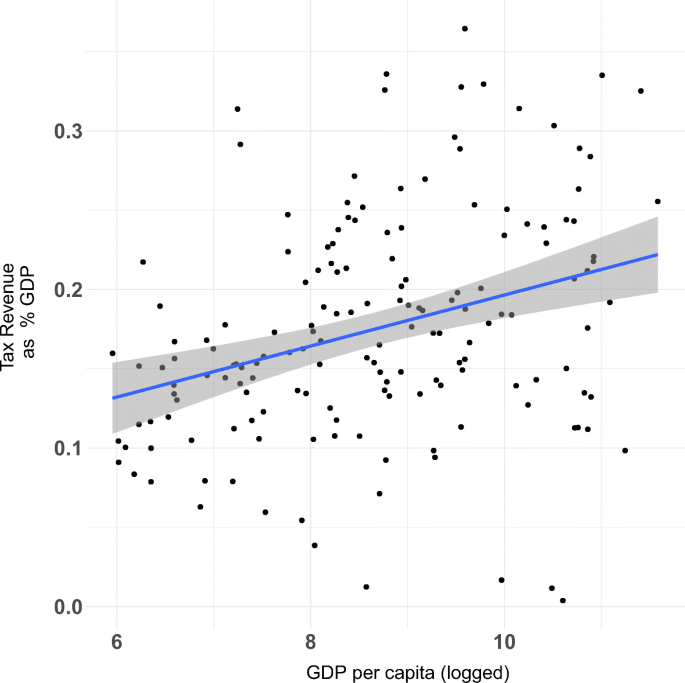

Relation between the tax revenue to GDP ratio and the real GDP growth rate average rate in years 20132018. This table lists the tax revenue collected from each state plus the District of Columbia and the territory of Puerto Rico by the IRS in fiscal year 2019 which ran from October 1 2018 through. Per Capita Total Government Revenue in the United States Federal State and Local Fiscal Year 2023 Income Taxes 10821 person Social Insurance Taxes 6134 person Ad valorem.

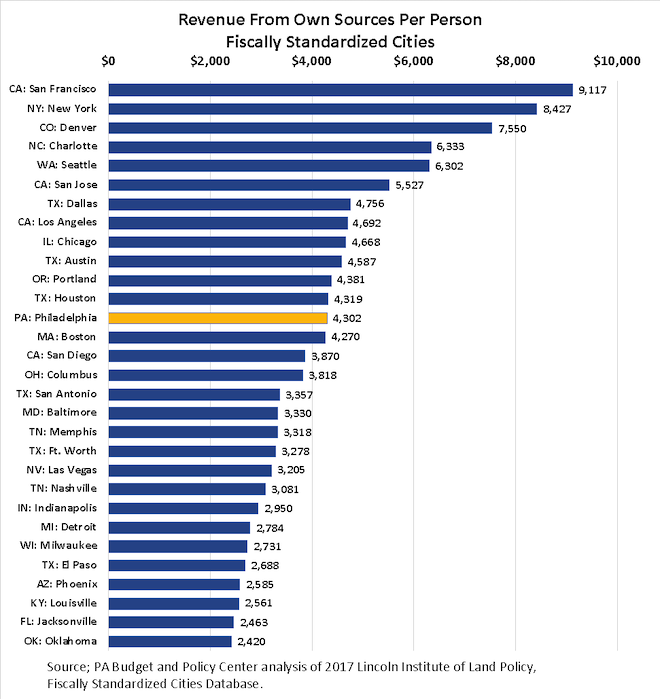

New Jersey has the highest per. This table includes the per capita. New York has the highest per capita local general revenue from its own sources at 5463 while Vermont has the lowest at 1230 per capita.

It can be regarded as one measure of the degree. Towns that receive the least in grants aid and revenue sharing per capita. States use a different combination of sales income excise taxes and user fees.

Research and Tax Rates. In 2019 state and local governments in the United States collected about 5664 US. Remember that tax revenue per capita refers to income tax that is tax.

Naugatuck is estimated to receive 383 million. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. This will give you tax revenue per capita in a given year.

Government 405tr USD Federal receipts as a percentage of GDP 181 Total state government tax revenue 127. GNI Per Capita 1962-2022. 188 rows Tax revenue as percentage of GDP in the European Union.

Dollars per capita in tax revenue. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Dollars using the World Bank Atlas method divided by the midyear.

Divide the income tax revenue by the taxable population. Revenues include fees charges for services and interest earnings as well as taxes. For most areas adult is defined as 18 years of age and older though in some.

Some are levied directly from residents and others are levied indirectly. This is an increase from the previous year when state.

Taxes In Philadelphia Aren T As High As Everyone Thinks

Stevens And Sweet Financial Is Income Tax In The Us Too High

All 50 States And Dc Ranked From Least To Most Taxed

How Much In State Taxes Each State Collects Per Person

Tax Revenue And Per Capita Income In Selected Countries 2008 Download Scientific Diagram

Oregon Below Average On Taxes High On Fees Oregon Center For Public Policy

Real Per Capita Growth In Government Revenue Over The Preceding Ten Year Period Marginal Revolution

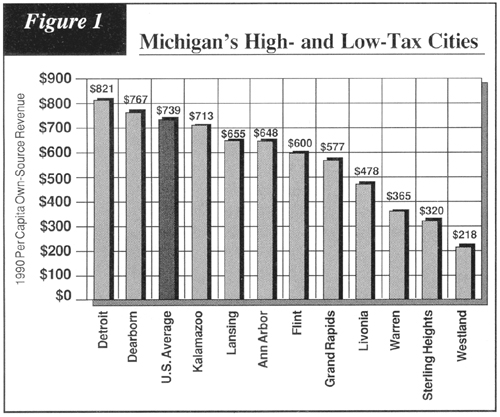

I City Tax Revenues In Michigan Today A Prosperity Agenda For Michigan Cities Mackinac Center

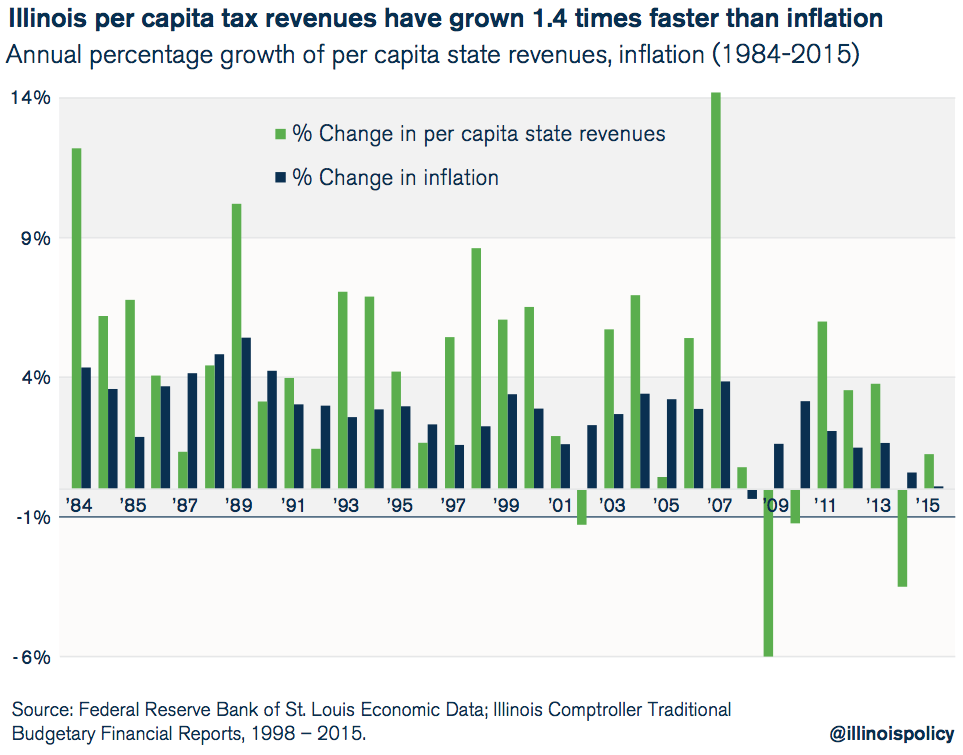

Illinois Has A Spending Problem Not A Revenue Problem Illinois Policy

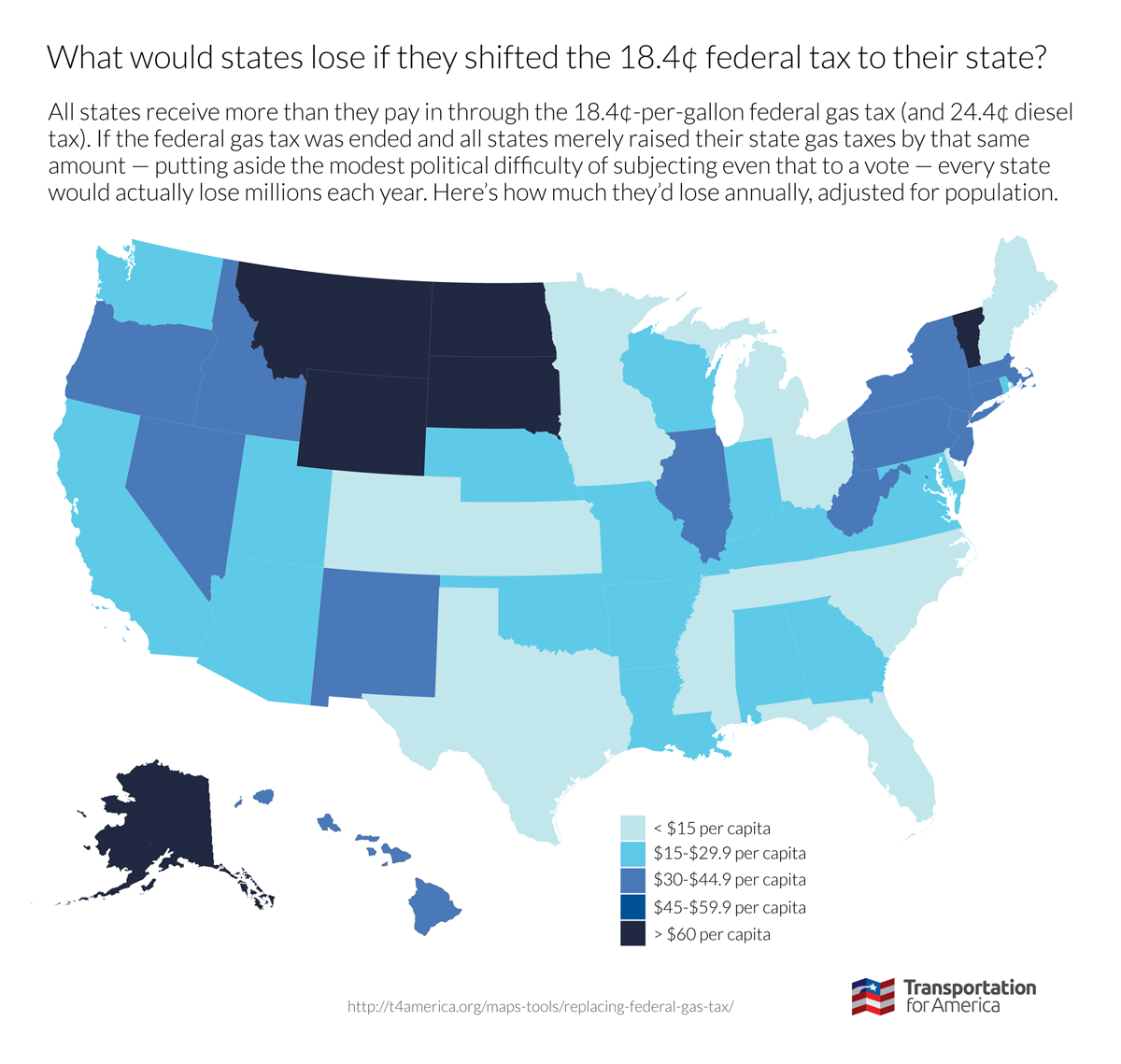

Transportation For America State Gax Tax Revenue Losses Per Capita Transportation For America

File Tax Revenue Vs Gdp Per Capita Owid Svg Wikimedia Commons

Illinois Taxes Illinois Economic Policy Institute Illinois Economic Policy Institute

File Us States By Federal Tax Revenue Per Capita Svg Wikimedia Commons

Average U S Income Tax Rate By Income Percentile 2019 Statista

Increasing Tax Revenue In Developing Countries

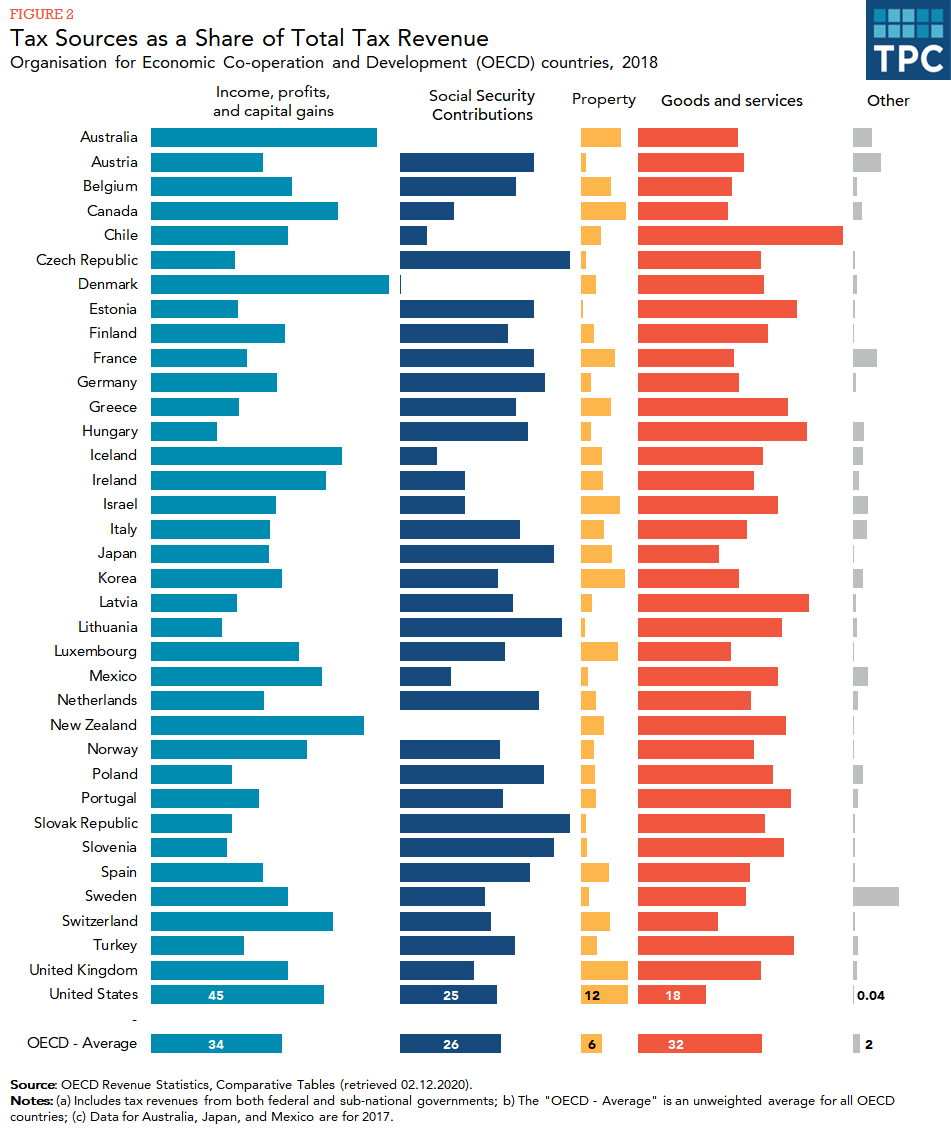

How Do Us Taxes Compare Internationally Tax Policy Center

Impacts Of Tax Structure At The State Level Summary Crowe Uw Madison

Tax Burden Per Capita Other State Austin Chamber Of Commerce